how much taxes are taken out of paycheck in michigan

Coronavirus Aid Relief and Economic Security CARES Act permits self-employed individuals making estimated tax payments. Employers who chose to defer deposits of their share of Social Security tax were required to pay 50 of the eligible deferred amount by December 31 2021 and the remaining amount by December 31 2022.

Hiring Employees In Michigan Llc Wages Laws Compliance Guide

I want to become a social worker.

. In 2020 an executive memo was released allowing employers to defer payroll taxes for employees. Is there any grant out there that I can apply for. If there is an grants out there please let me know I really want to finish college.

The IRS will issue you a tax refund. In light of the recent COVID-19 pandemic many states have implemented temporary changes in unemployment eligibility and benefits to offset these increasingly difficult times. Register with your employees state tax agency.

For example you might complete your tax return and then realize that your total tax liability is 6000. If you receive a paycheck the Tax Withholding Estimator will help you make sure you have the right amount of tax withheld from your paycheck. If your employee works from home in another state there are three things you need to do.

If you paid more tax than you owe either through withholding or estimated payments you have overpaid. Since youll be withholding income taxes in your employees home state youll need to register with the state and possibly local tax agencies. It is hard for me to finish my degree because right now I am short of 420000.

Because of this some basic calculation is required to figure out the wage amount used as a base for the benefit level. Additionally IRS Notice 2020-65 allows employers to defer. I also works in the School System working with children.

Eric D Pratt wrote. Coronavirus Tax Relief for Self-Employed Individuals Paying Estimated Taxes. Taxes for remote employees out of your state.

If you have paid in 6500 through withholding over the course of the tax year youll receive a 500 tax refund.

Many People Live Paycheck To Paycheck And Missing Any Time Because Of A Workplace Accident Can Result In A Financial Dis Paying Taxes Worker Workplace Accident

Tax Cuts Coming But Michigan Already A Low Tax State The Voice

A Complete Guide To Michigan Payroll Taxes

Michigan Sales Tax Calculator Reverse Sales Dremployee

Tax Cuts Are Coming But Michigan Is Already A Low Tax State Citizens Research Council Of Michigan

Michigan Legislature Passes 2 5 Billion Tax Cut

State Of Michigan Sales Tax Solutions Troy Franskoviak

Michigan Salary Calculator 2022 Icalculator

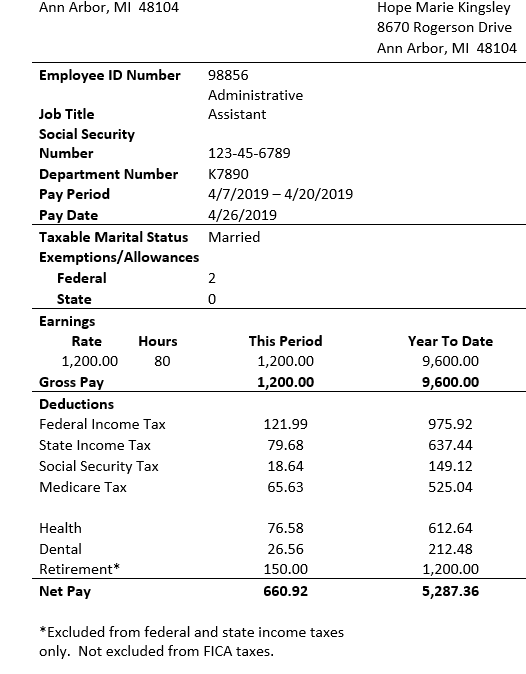

For The Federal And State Taxes The Retirement Is Chegg Com

Gov Gretchen Whitmer Seeks Insurance Refund It Could Pay 80 To 700 Per Michigan Driver Bridge Michigan

Information And Resources For Business Owners On Covid 19 Michigan Retailers Association

Tax Cuts Are Coming But Michigan Is Already A Low Tax State Citizens Research Council Of Michigan

Free Michigan Payroll Calculator 2022 Mi Tax Rates Onpay

Michigan S Property Tax Burden And How It Has Changed Over Time Citizens Research Council Of Michigan

Is My Pension Subject To Michigan Income Tax Center For Financial Planning Inc